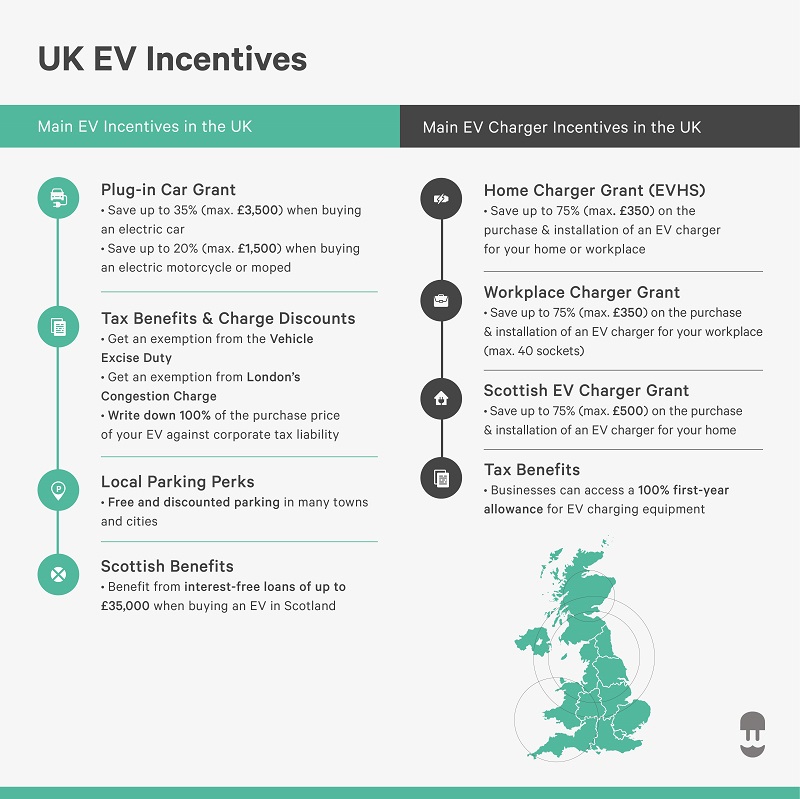

In his march 2020 budget chancellor of the exchequer rishi sunak confirmed that motorists buying electric cars would continue to benefit from the plug in car grant to 2022 2023 but it would reduce from 3 500 to 3 000 and cars costing 50 000 or more would be excluded.

Electric car tax relief uk.

Use the car tax calculator to calculate the car tax due for any electric vehicle or find out more at our car tax microsite.

Government has published updated company car tax bands up to 2023 with electric vehicles exempt from tax in 2020.

New and unused co2 emissions are 50g km or less or car is electric first year allowances.

Pure electric cars and some hybrids will usually qualify for the enhanced capital allowances ecas available for low 75g km or less in 2017 18 but 50g km or less from april 2018 and zero emissions vehicles.

This electric car tax relief is potentially a big saving for employees making them more likely to choose an electric vehicle as a company car.

Description of car what you can claim.

New and unused co2 emissions are between 50g km and 110g km.

Prior to april 2020 the benefit in kind on pure electric cars was 16 whereas the 100 tax relief in the company meant effectively 19 corporation tax was saved.

Company car tax benefit in kind from 6th april 2020 both new and existing tesla cars will be eligible for a 0 percent bik rate for the 2020 21 tax year.

Electric vehicle loan low carbon transport business loan.

Electric company car tax.

All electric cars pay zero company car tax in 2020.

With the cost of the vehicle able to be claimed back against your corporation tax bill in year one a 35 000 investment in an electric vehicle would yield a 7 000 saving in tax relief.

However in second and third years it became less attractive as the benefit in kind in these years was still 16 with no additional tax relief.

The bik rate will rise to 1 percent in 2021 22 and to 2 percent in 2022 23 being held at 2 for 2024 24 2024 25.

Factsheet updated to include april 2018 changes of rates for vehicle excise duty company car tax van benefit charge car fuel benefit charge and van fuel benefit charge plus new.

Summary of electric car tax benefits.

The amount of company car tax payable depends on the official value of the car called the p11d the benefit in kind bik rate and the recipient s tax code.

If an electric car has co2 with less than 50g km of emissions can also qualify for 100 first year capital allowances.